866-765-3151

Take Control of Your Profits – Stop Paying Credit Card Fees with NoblePay’s Hassle-Free Solution

"As a business owner, I know how processing fees cut into profits. That’s why I created NoblePay—to partner with top processors, offer cutting-edge technology, FREE equipment, and eliminate your fees so you keep more of what you earn.

-Christopher Swift, Founder NoblePay

Save 95% on Processing Fees – Start Keeping More of Your Revenue!

Save thousands annually by eliminating 95% of your processing fees – reinvest in your business’s growth with a cash discount program!

Next-Day Funding – Access Your Money Faster!

Say goodbye to waiting 2-3 days for your sales deposits. With next-day funding, your money is available the following day, allowing you to keep your business running smoothly!

Accept Payments Anywhere with Ease – In-Store, Online by phone or mobile!

We understand that today’s businesses are multichannel, which is why we offer seamless payment solutions for in-store, online, and mobile transactions – wherever your customers are.

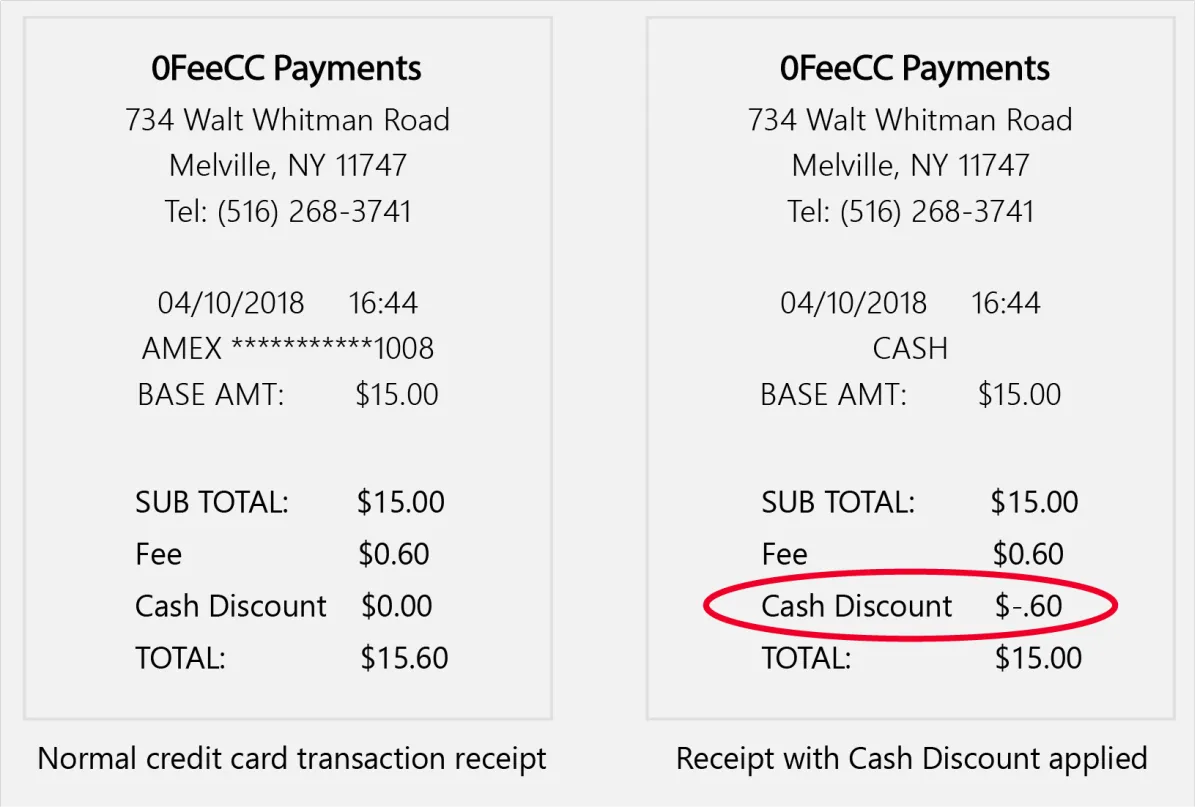

What is a Cash Discount Program?

Save Big: Understanding Cash Discount Programs

A cash discount program allows you to pass on the cost of credit card processing fees to customers who choose to pay with a card. Customers who pay with cash or debit receive a discount, while credit card users cover the processing cost. This program helps your business eliminate fees and increase profits. We want you to know that we want your experience to be the best you've ever had in payments. Thats why our partners, PayAnywhere, VizyPay & Electronic Payments are simply the best in the business.

Key Benefits

Keep 100% of Your Revenue

With a cash discount program, you can say goodbye to losing profits on every credit card transaction. Instead of absorbing the fees yourself, your customers who choose to pay with a card cover those costs. This means your business keeps 100% of the sale, allowing you to reinvest in your business and increase your margins immediately. No more losing hard-earned revenue just for offering payment options.

Offer Flexibility to Customers:

The cash discount program gives your customers the power to choose how they pay. Those who prefer to pay with cash benefit from a discount, while customers using credit cards continue enjoying the convenience of paying with plastic. By giving your customers more options, you not only improve their experience but also protect your business from unnecessary fees. It's a win-win solution that keeps your customers happy and your profits intact..

Seamless Transition:

Worried about the hassle of switching to a cash discount program? Don’t be. At NoblePay, we take care of everything for you. We provide clear signage to inform your customers about the program and set up your terminals for a smooth transition. You’ll be ready to start saving without any disruptions to your operations, and your customers will fully understand the benefits of paying with cash or credit. We make the process quick, easy, and hassle-free.

Fully Legal and Compliant:

Concerned about legality? Cash discount programs are completely legal and fully compliant with all credit card network rules. Rest assured that you're on the right side of the law. By adopting this proven method, you eliminate processing fees with confidence, knowing that your business is protected. We ensure that you’re operating within all regulations so you can focus on growing your profits without worry.

Who Else Is Doing This?:

Cash discount programs aren’t new—gas stations have been using this model for decades, passing credit card fees onto customers while rewarding cash-paying customers with lower prices. What was once a strategy exclusive to certain industries is now open to all businesses, regardless of size or category. Whether you run a retail store, restaurant, or service-based business, you can now implement the same proven strategy to eliminate fees and boost your bottom line. It's a widely accepted practice that customers are already familiar with, making it an easy transition for your business.

Flat Rate Pricing Is Like Your Very Own Revenue Generating Machine

It's your money, we help you keep more of it.

Your monthly credit card processing volume

Your additional annual revenue when you don't pay processing fees.

- $/Year

The Story Behind NoblePay – Helping Business Owners Save Big and Simplify Payments

As a business owner, I’ve experienced the frustrations of high credit card fees firsthand. I created NoblePay to give business owners like you a solution to keep more of your profits.

As both a business owner and a payments expert, I understand the challenges you face. I've been in payments since 1995 and started NoblePay in 2008. I’ve been where you are, watching profits slowly slip away due to ever-increasing processing fees. But I didn’t just learn about cash discounting from the outside—I live it every day through my other business, We Care Car Care. To avoid the same financial drain, I decided to practice what I preach and implemented a cash discount program for We Care.

This unique perspective sets me apart from others selling payment solutions. I don’t just talk about the benefits—I’m proof that they work. At We Care, our customers have had no issues with the cash discount model, and it has truly benefited our business. For the few who ask questions, it’s simply a matter of educating them on how to communicate the value to their own clients.

And that’s why I’m sharing this with you. It’s not about me—it’s about you.

I understand your apprehension because I’ve felt it too. But I’m here to show you how this can change your business. No more watching your hard-earned profits shrink away. You’ll be able to keep more of what you make and improve your bottom line, just as I’ve done with mine. You deserve a payment solution that actually works for you—and I’m here to help make that happen.

- Christopher Swift, Founder NoblePay

Think Outside The Square

PayAnywhere: Your Complete Payment and Business Management Solution

Hiring Tools

Post your openings for free on the top job boards or via optional paid postings. Sort, rate, and schedule your candidates from all sources at once.

Employee Management

-Build a team with unique roles and permissions.

-Assign employees as administrators, managers, cashiers, or reporters with customizable levels of access.

-Break down sales by employee.

-Keep tabs on your staff even while you're away.

-Generate reports on individuals or groups of employees by transactions completed, volume sold, tips, payment method, and more.

-Protect your point of sale.Avoid losses and track employee activity by customizing who can log in, complete a sale, issue a refund and update stock counts.

-Securely share your back office tools.

-Give trusted employees access to the business management and reporting features within Payments Hub.

Scheduling

Drag & drop scheduling that forecasts labor costs as you go.

Send to your team by text, app, and email.

Time Clock

Allows your employees to:

-Clock in

-Take breaks

-Declare tips, and rate their shift right from the Payanywhere app.

Inventory Management

Manage your inventory and the products you sell.

It’s simple to sell, track, and restock your items with Payanywhere’s free inventory tools.

Build a cloud-based library

Your own flexible catalog of products that’s easy to sort and accessible from any device.

You’ve never felt this organized.

Save time by uploading your inventory in bulk with Payanywhere's easy-to-use template.

Items & categories

Create items with multiple price variants.

Sort them into categories for faster access at the time of a transaction.

Modifiers

Customize your items at the time of sale with modifier sets.

Discounts

Create preset discounts based on percentage or dollar amount, or add one on the fly. Apply to an entire order or a single item.

Sell with one tap

The items in your library are immediately available on your point of sale. Just tap an item to add it to an order.

Go faster with barcode scanning

Use a Bluetooth barcode scanner or your device camera to quickly scan an item and add it to an order.

Track stock with ease

Create custom low stock alerts per price line, and get notified immediately when an item is out of stock. Your inventory syncs in real-time across all your devices no matter where sales are made.

See what's hot and what's not

Track sales by item, category, modifier, and discount.Export stock reports, item performance, and transactions by category.

Invoices

Send invoices and never miss a payment.

Get paid with one-time or recurring invoices that your customers pay online. Email your customers invoices from your point of sale or your back office. Turn any in-person transaction into an invoice directly from the Payanywhere app, or send directly from your Payments Hub portal.

Automate recurring billing cycles

-Generate repeat invoices automatically at the frequency you set.

-Allow customers to enroll in autopay.

-Customers on a recurring invoice cycle can opt to automatically be charged using autopay.

-Add custom branding to your outgoing invoices and payment pages.

-Create a seamless customer experience by adding your logo and contact information to every touchpoint.

Recurring Billing

-Automate recurring billing cycles.

-Generate repeat invoices automatically at the frequency you set.

-Allow customers to enroll in autopay.

-Customers on a recurring invoice cycle can opt to automatically be charged using autopay.

Sales Reporting

Maximize your sales with data-driven insights from Payanywhere.

Stay ahead with advanced analytics and real-time dashboards for everything from sales trends to employee performance. Access reports anytime, anywhere, through our app or secure online portal.

Key features include:

Real-time sales summaries with customizable reports.

Employee tracking: Sort by volume, transactions, and create instant -reports.

Inventory management: Track stock levels, set alerts, and sync across devices.

Customer insights: Analyze visits, spending, and feedback.

Make smarter decisions with powerful tools to streamline operations and grow your business.

Customer Management

When you're running a business, nothing is more important than your relationship with your customers.

Customer management that works for you.

-Gain detailed yet easy-to-understand insights into your customers with our customized reporting.

-Create customer profiles. Then, sort them by filters you choose, so that you can sell to your customers more effectively than ever before.

Now, you'll know:

-Who spends the most money during their visits.

-Who visits your business most often.

-Who is a first-time buyer and more.

-You can even export your customer list to use any marketing tools you choose, allowing you to more effectively advertise to your customers via email campaigns, SMS and so on.

-Solicit customer feedback & reviews.

-Want to find out more about your customers and how to better serve them? Just ask them!

-Customizable receipts allow you to ask for customer feedback via surveys that allow them to rate their experience.

Virtual Terminal

Accept payments in your web browser.

The Virtual terminal feature within the Payments Hub portal allows you to accept credit cards right from your computer.-Take orders online or over the phone and process payments on the spot.-Key in credit card details and process a payment anywhere you have an internet connection.-Your transactions will instantly appear on your activity page.

Free Equipment with Every Account

Get started with a free terminal, courtesy of our trusted processing partners, and begin eliminating fees while boosting your bottom line.

Payanywhere Smart POS.+

Payanywhere Smart Flex

PAX E600

Smart Flex Point of Sale.

Free equipment placement.

$29.95/mo license.

0% processing.

Learn more.

Smart Terminal

Free equipment placement.

$24.95/mo license.

0% processing.

3-in-1 Bluetooth Credit Card Reader

Free equipment placement.

$9.95 monthly.

0% processing.

DeJaVoo Z8

Free equipment placement.

$9.95 monthly.

0% processing.

On-site technicians

Setup custom tax rates for doing business across municipalities

Send receipts via email or text message

Home service providers

Accept tips and set custom tip presets

Save customer info and cards on file for repeat business

Transportation companies

Charge customers at time of sale with mobile card readers

Create a new sale via Quick Entry or choose frequently used services from the Item Catalog

Effortless Installation, Full Support

Chris and his team will handle the entire setup at no cost. You'll receive comprehensive training on your new equipment, plus expert guidance on how to confidently explain the new payment process to your customers.

Professional services

Send invoices via email or text

Save cards on file for easy billing of established clients

Potential to lower fees with Level III Interchange Qualification

Healthcare providers

Setup scheduled payments for future appointments

Charge customers over the phone with the Virtual Terminal

Nonprofit organizations

Save customer information and gain individual-level insights

Create recurring payments for regular donations

Accept donations on social media or on the web with Payment Links

Exceptional Support, Every Step of the Way

When you have a question, you shouldn’t have to wait. Chris has personally selected partners who make support their top priority. More often than not you'll be able to get support within 30 seconds or less!

Salon & spas

Create visual Favorites pages for quick access to popular services

Set custom preset tip amounts for easy customer gratuitySend invoices via email or text

Save cards on file for easy billing of established clients

Potential to lower fees with Level III Interchange Qualification

Specialty food & beverage businesses

Utilize Item Catalog for fast and easy checkout

Use custom discount rates for special promotionsSetup scheduled payments for future appointments

Charge customers over the phone with the Virtual Terminal

Automotive providers

Save customer card on file for repeat business

Manage employee access with role-based user profilesSave customer information and gain individual-level insights

Create recurring payments for regular donations

Accept donations on social media or on the web with Payment Links

See How Other Business Owners Are Saving with NoblePay

Kelly Schoeberl, Owner

Olive Juice Studios

We took credit cards with PayPal before working with Chris at NoblePay. Now we're paying so much less than we ever did before. In fact, a local vendor walked into our gallery, asked to see our statements (assuming he could do better) and said he couldn't give us a better rate and that he'd be wasting our time to try.

Jon Benson, CEO Sellerator.com

I’ve been working with merchant accounts for over a decade, and I’ve run into almost every problem you can think of: extreme withholding periods, lack of flexibility around launches, poor customer support, and more. Working with Christopher at NoblePay has been a totally unique experience. Not only are our rates better and withholdings lower, Christopher responds to us very fast. These guys know how to work with Internet marketers to a degree I’ve yet to encounter with any other merchant service. Highly recommended!

Tim Brown, CEO

Dr. Kareem Samhouri Fitness, LLC

Chris is our main man when it comes to merchant accounts. He's always got our back and is amazing to work with. Chris handles all of our merchant accounts and looks out for our accounts as if they were his own. Chris is who we always recommend to other internet marketers. He'll definitely get you the best deal available and cut out all of the merchant processor BS for you.

Mary Young, Ph.D.

Licensed Professional Counselor & Licensed Clinical Social Worker

As a therapist in private practice I want to offer my patients the convenience of accepting credit cards for payments, without adding costs associated with terminal equipment. I have used a couple of services over the years, and found that although they often look good up front, the add on fees continued to grow while the service level does not. My last company required me to give them a sizable deposit.

When I discovered NoblePay, I asked Chris a lot of questions looking for the hidden junk fees. He was both knowledgeable and helpful. I felt like he took more than ample time for me to feel comfortable that I was not going to have any surprises fees with his service.

I’ve been with Chris for many years and I’ve never had an issue. The service is reliable, and Chris has remained available to answer any questions along the way. My patients appreciate the flexibility of using their credit or debit cards and I’ve improved my cash flow without adding unnecessary costs.

Todd Kuslikis

aShotofAdrenaline.net

Chris has been incredible to work with. He is responsive and understands the continuity business. I highly recommend him to anyone I talk to that is doing continuity.

Kristina Carter

Vrai Studios

When Chris called to ask me how things were going after I signed and ask me for a referral I was happy to help!

My experience has been so much better; I am thrilled to tell people about it!

My last company sold me on a nice low rate but what they didn’t tell me was how many hidden fees there were. My bill would literally come with hundreds of dollars in fees that were not line itemized so I had no idea what they were for!

When I would call customer service to find out, they would tell me they were just fees and then when I would demand to talk to a manager to get a more specific breakdown, I would be put on hold indefinitely until my call dropped or they dropped me. No one ever answered my questions or even made an attempt.

With Chris I know exactly what I am paying each month.

Every customer service interaction has been very helpful and quick to respond but honestly I haven’t even needed them since I set up my account. I am very happy I switched, I am saving hundreds of dollars a month and I have a payment system that allows me to get paid quickly so I have less stress which you can’t put a price tag on! Thank you Chris and NoblePay!

Pickle Barrel

Carla was one of the first business owners in her area to implement cash discounting.

Watch her tell her story. The concerns she had about being the first and how well things are going since adding cash discounting.

Frequently Asked Questions

What is a Cash Discount?

A cash discount is when a business offers a lower price to customers who pay with cash instead of credit or debit cards. The listed price remains the same, but a discount is applied at checkout for cash payments.

What is a Cash Discount Program?

A cash discount program adjusts pricing by offering a discount to customers who pay with cash. The listed price is slightly increased for all customers, but those paying with cash receive a discount at checkout. For card payments, the price increase is applied to cover processing fees, helping eliminate unpredictable processing costs for the business.

What a Cash Discount Program is NOT?

There’s often confusion around cash discount programs. According to card brands, merchants cannot penalize customers for using credit cards. Adding fees at checkout, like “service fees” or “non-cash adjustment fees,” is considered a surcharge and must follow strict compliance rules.

Thanks to the Durbin Amendment, businesses can legally offer discounts for cash payments without any registration or compliance requirements. Surcharges, however, are capped at 3% (as of April 2023) and require registration. With our guidance, you can ensure your business stays compliant while offering seamless payment options.

What is Dual Pricing?

Dual pricing allows businesses to display both cash and card prices for each product. Customers choose their payment method, and the POS system automatically calculates the correct price. With the right setup, including a POS that supports dual pricing and a flat-rate merchant provider, you can offer transparent pricing without worrying about rising processing fees. The difference between cash and card prices covers all processing costs, ensuring predictable profits without extra fees.

What is Flat-Rate Pricing?

Flat-rate pricing raises listed prices by 3-4%, and customers paying with cash receive a discount that brings the price back to the original amount. This method ensures that card processing fees are covered, while cash customers benefit from a lower price. It’s important to use compliant POS systems to avoid non-compliant practices like disclosing a service charge at the register. Chris will guide you through setting up a transparent, customer-friendly cash discount program.

Flat-Rate vs. Dual Pricing Cash Discount Programs

Flat-Rate Pricing:

All prices are increased by 3-4%, and customers paying with cash receive a discount. Card fees are covered, so you keep 100% of the sale.

Dual Pricing:

Displays both cash and card prices upfront. The POS system calculates the difference, allowing customers to see exactly what they’ll pay based on their payment choice. This method provides transparency and eliminates processing fees without hidden costs.

Both programs help you avoid rising processing fees while keeping profits consistent.

Surcharge vs. Cash Discount – What’s the Difference?

Surcharge:

A surcharge adds a fee to credit card transactions, making the customer pay more than the advertised price to cover processing costs.

Cash Discount:

A cash discount reduces the total price when a customer pays with cash, meaning the customer pays less than the advertised price.If you’re adding a fee at the register (e.g., “service fee” or “non-cash adjustment fee”), it's a surcharge. Visa allows discounts for cash payments, but the discount must come from the standard price..

Will I Lose Customers?

Raising prices is always a concern, but with this program, most customers won't notice a small price increase. We're talking cents on the dollar to cover credit card fees. If the program doesn’t work for your business, we can always lower your rates. Given rising costs from inflation and other challenges, now is the perfect time to ensure your business stays profitable without worrying about unpredictable card fees. This approach is working in all types of communities across the country.

What Will My Processing Bill Look Like?

Your bill will be simple and transparent. While traditional fees don’t disappear, we cover them for you. With our cash discount program, you’ll pay a flat monthly subscription fee, regardless of your transaction volume. Even as processing costs or interchange fees rise, your bill won’t change. You’ll always pay 0% in processing fees, and your statement will be easy to understand, with no surprises.

Why Do I Need You If I Already Add My Own Fee?

While adding your own fee might seem like it covers processing costs, it can put your merchant account at risk. Charging more than your actual processing rate violates merchant agreements and could lead to your account being shut down. Our program is fully compliant and provides a flat rate, ensuring you stay within regulations. Plus, you’ll be able to deduct 100% of processing fees, unlike when you add your own, keeping more money in your pocket each month.

Do You Offer Other Merchant Account Programs Besides Cash Discount?

Yes! We also offer traditional processing, though fees apply. Chris has been helping businesses accept credit cards since 1995, including mid to high-risk merchants. Through exclusive processing partnerships, we can help you reduce chargebacks, comply with FTC regulations, and set up a stable payment system for your business.

This site is not part of, or endorsed by, Facebook or any social medial platform in any way. FACEBOOK is a trademark of FACEBOOK, Inc.

All product names, logos, and brands are property of their respective owners. All company, product and service names used in this website are for identification purposes only. Use of these names, logos, and brands does not imply endorsement.

NoblePay is a gateway powered by NMI.

Copyright 2024 All Rights Reserved. Privacy.